Fintech is one of the most rapidly developing industries nowadays. Thanks to their convenience and reliability, fintech solutions are gradually replacing traditional banking, e-commerce, payment methods, etc. So if you came up with the idea to create a fintech app, it’s high time to implement it to life.

Fintech Apps Market Overview

In general, the fintech app development market is expected to reach more than $37,343 billion by 2030. Speaking of the fintech funding deals in Q1 2022, CB Insights states that their total number was 1482, which is 20% more than in Q1 2021. Also, based on Statista research, more than 26,000 fintech startups were registered worldwide in 2021 (with 10,000 in the USA alone).

The diversity of the fintech apps presented on the market is growing every day. The most popular types of fintech apps are:

- digital payment apps

- banking apps

- personal finance apps

- investment apps

- loan apps

- insurtech apps

- buy now, pay later (BNPL) apps, etc.

As of 2022, among the most popular fintech apps are PayPal, Coinbase, Revolut, Robinhood, MoneyLion, and others.

What do you need to know to develop a fintech app?

- What is the best hiring option for fintech app development?

First of all, to start the fintech app development process you need to decide who you will entrust with the development of your application. You can hire a freelance developer or a fintech software development company. Both options are good, everything depends on your budget and app complexity. However, if you want to cover all your app development needs in one place, don’t bother with project management, and get not just code but detailed consultations regarding tech and business aspects of your app, it will be better to hire a tech team. Keep in mind that you can save your project budget by hiring a software development company that is located in a region with lower rates. For example, pay attention to the tech teams from Eastern Europe and Ukraine in particular. They are highly appreciated by foreign clients (especially from the USA) because of their reliability, profound expertise, and ability to deliver a high-quality product for a relatively low price. You can contact Perfsol – a Ukrainian fintech app development company.

- What is the approximate cost of fintech app creation and how can you make your app development process more cost-efficient?

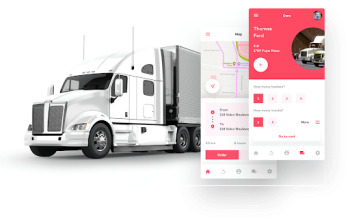

To be honest, it’s impossible to provide you with precise numbers as fintech app development cost depends on various factors: tech stack, feature set, design complexity, number and type of experts you need to implement your project, etc. However, we can make a rough estimation based on one of our projects. Recently, Perfsol has developed a loan app called MXNEY. An average rate for software development is $40/hr (in comparison, the average rate in the USA is $80-100 per hour). The project took approximately 800 hours to complete. So we can assume that this fintech app development cost more than $30,000.

Secret tip to make your development process cost-efficient: start with MVP creation. Minimum Viable Product is the most basic version of an app that contains the crucial features only. However, this app can be launched to the market, so you can get your first users, gather their feedback, earn your first profit and invest it in further app development.

If you have any questions regarding fintech app development or need expert consultation, be quick to contact us and get a quote!